Today’s Smart Money Question:

If you’re like most people, you’ve probably steered clear of reverse mortgages for one reason or another, but there’s quite a bit more to them that isn’t generally discussed. Matt brings in Harlan Accola to demystify the subject. Who should consider one, and who should not? What kind of options are available and what are the costs associated? And why do reverse mortgages have such a bad reputation?

(Click the featured times below to jump forward in the episode)

Here Are Just A Handful Of Things You’ll Learn:

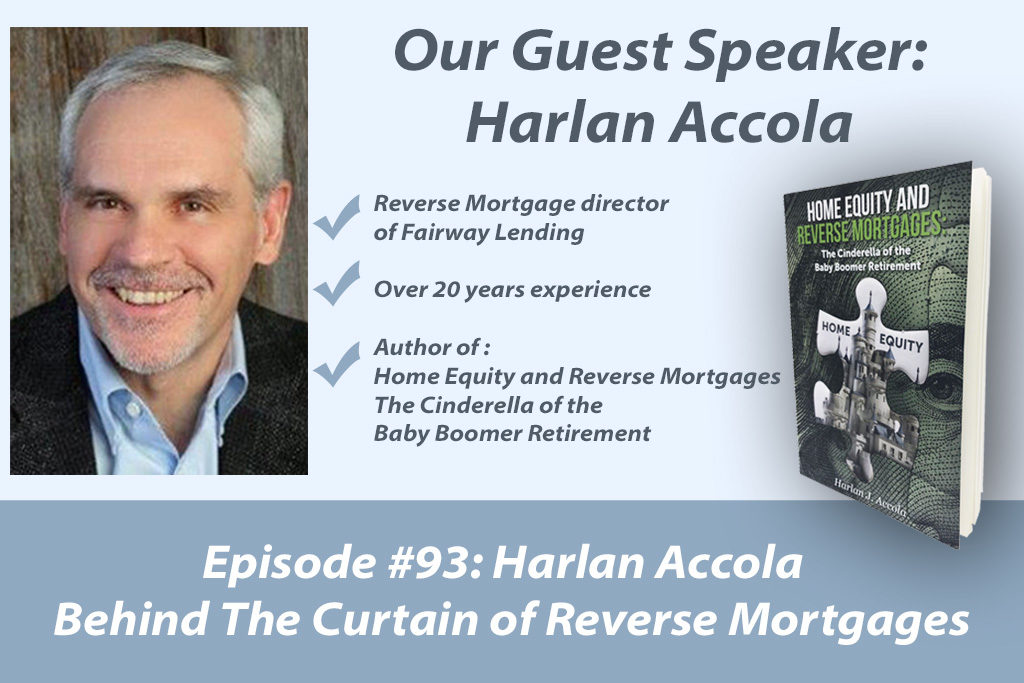

[1:34]– Harlan Acolla

- Matt introduces his guest on the podcast; Harlan Acolla, the reverse mortgage director for Fairway Lending.

[2:37]– The Four Biggest Concerns People Have About Reverse Mortgages

- Harlan dives into what a reverse mortgage is and what the cost of having one is. He also talks about the four biggest concerns people have about reverse mortgages including how it will affect your surviving spouse and your beneficiaries.

[8:32]– How are Reverse Mortgages Structured?

- Harlan talks about surprising ways to structure a reverse mortgage.

[11:58]– Why you should take out at RELOC at age 62

- Harlan goes over why it’s a good idea to take out a RELOC (Reverse Mortgage Line of Credit) at age 62 and how it differs from a regular line of credit.

[12:54]– Guaranteed Increase In Your Line Of Credit

- Harlan talks about a feature that surprises people the most. You are guaranteed to have a 5% increase in your line of credit every year no matter what the value of your house is.

[14:54]– You Don’t Have To Use It

- Matt and Harlan talk about how if you do have a line of credit you aren’t obligated to use it.

[17:39]– Who Shouldn’t get A Reverse Mortgage

- 95% of people should get a reverse mortgage. Harlan goes over why the remaining 5% shouldn’t.

[23:41]– What Are The Qualifications?

- Harlan talks about what the qualifications are for getting a reverse mortgage.

[29:25]– Don’t Try This At Home By Yourself!

- Harlan goes over why it’s important to have a financial advisor with you when you go in to set up a reverse mortgage.

[31:45]– Drugs, Sex and Reverse Mortgages

- Harlan talks about a chapter in his book. He dives into how a reverse mortgage can be good thing or a bad thing.

[34:17]– Not All Financial Advisor’s are the Same

- Matt and Harlan talk about how important it is to have a well diverse financial advisor; not one who is just pushing a product.

[36:06]– Downloads

- Here are the downloads Matt talks about in this episode: The Coordinated & Non Coordinated Strategy & How Does The Reverse Mortgage Line Of Credit Work?

Other Notes

[4:37]– There are 7 trillion dollars sitting in home equities.

[10:51]– Take out a reverse mortgage when you don’t need the money.

[13:23]– They allow you to have access to a larger part of your equity even if the value of your house hasn’t gone up.

The Answer:

Do You Have A Smart Money Question?

Ask Matt your smart money question. Click here.

More From Matt:

The host: Matt Hausman – Contact – Resources – Call: 610-719-3003

Subscribe To The “Smart Money Questions” Podcast: