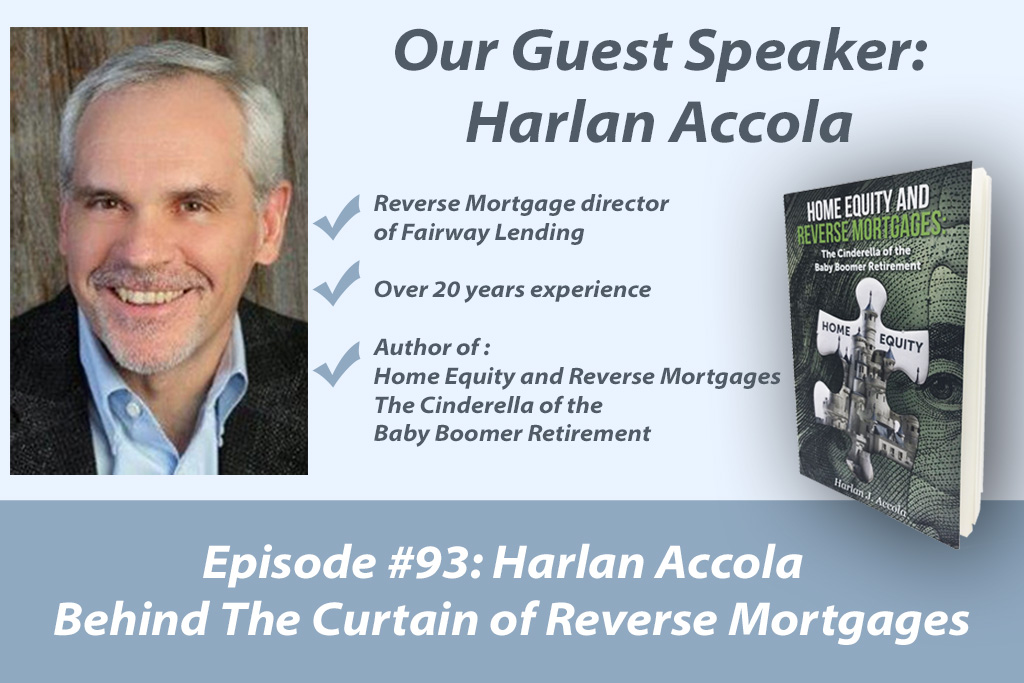

Episode #93: Harlan Accola – Behind The Curtain of Reverse Mortgages

Today’s Smart Money Question: If you’re like most people, you’ve probably steered clear of reverse mortgages for one reason or

Today’s Smart Money Question: If you’re like most people, you’ve probably steered clear of reverse mortgages for one reason or

Today’s Smart Money Question: This week, let’s look into some basic steps that you can take towards building and protecting

We love to feature your questions on the podcast. Join us as we answer your email questions on Social Security, market recessions, and inherited stocks.

Many couples look to relocate or downsize in retirement. Relocating can be beneficial, but it presents questions you’ll need to answer before you move.

Today’s Smart Money Question: Risk tolerance is a buzzword you often hear in the financial industry. It’s important to understand

Today’s Smart Money Question: There’s a conversation Matt has with clients all the time. It’s about market volatility. It’s one

oin us as we feature your email questions. We’ll cover paying off your house and financial planning for married couples.

This time of year, we tend to discuss the attitude of gratitude. In the spirit of the season, we want to take time to be thankful.

On this edition of the podcast, Matt addresses scams that could attack your wealth and the question of whether a market crash could eat into your portfolio.

As we move from work to retirement, we experience a paradigm shift. Suddenly, we’re moving from wealth accumulation to income distribution. Matt explains.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Smart Money Questions and our editorial staff. Material presented is believed to be from reliable sources, however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your individual advisor prior to implementation. ©2018 All written content on this site is for information purposes only. Opinions expressed herein are solely those of Old Security Group and our editorial staff. Material presented is believed to be from reliable sources, however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your individual advisor prior to implementation. Fee based financial planning and investment advisory services are offered by Old Security Group a Registered Investment Advisor in the State of Pennsylvania. Insurance products and services are offered through Old Security Trust Corp. Old Security Group and Old Security Trust Corp. are affiliated companies. The presence of this web site shall in no way be construed or interpreted as a solicitation to sell or offer to sell investment advisory services to any residents of any State other than the States of Pennsylvania, Delaware and Maryland or where otherwise legally permitted.