Today’s Smart Money Question:

People ask us what our retirement planning process looks like. Join us on a two-part series as we detail one couple’s seven year journey through retirement.

(Click the featured times below to jump forward in the episode)

Here Are Just A Handful Of Things You’ll Learn:

2:09 – A Bit Of Context.

- This couple met us at a workshop in 2012. He was 64, and she was 63. She was already retired, and he was hoping to retire at his full retirement age of 66. As we examined their assets, we saw that most of their assets were in qualified retirement accounts. Like many working professionals, they put their money in IRA and 401(k) accounts. This meant they were due for a large tax bill in retirement. Furthermore, we learned they owned a primary home here in the area as well as a vacation home down south. In discussing their retirement goals, we discovered they wanted to lower their tax burden, maximize Social Security, develop an income plan, and be able to do some traveling in retirement.

6:30 – Mitigating Risk Exposure & Lowering Taxes.

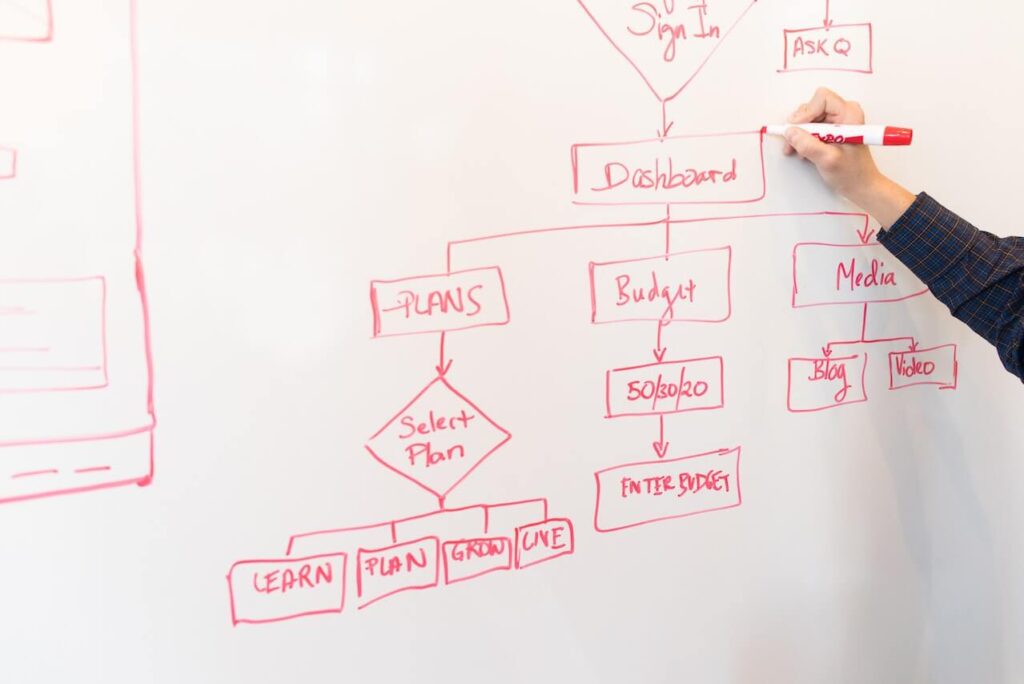

- We knew we had a couple of years before he was going to retire, so we took their 401(k)s and IRAs and put them in different “buckets” of money with different amounts of risk associated with each. We did that to mitigate their risk exposure. Additionally, IRA money is taxed as ordinary income when you withdraw it, so it’s important to lower the amount you’ll pay in taxes by placing that money in other “buckets.” Uncle Sam is going to take his cut whether that account makes money or loses it. This means if the market takes a dip, you’re essentially going to lose twice; once to the market, and once to the government. We didn’t want this couple to face that possible reality.

8:03 – Jumpstarting The Process.

- Around December of 2012, the husband was asked to leave his firm after working there for more than 36 years. The were offering him a hefty severance package to ride off into the sunset. Suddenly, this couple’s plan to fully retire in two years became an early retirement emergency. This man was being forced into an early retirement, and we needed to determine a withdrawal strategy, so this couple would continue to have monthly income. We also needed a healthcare plan that would cover his wife’s expenses until she qualified for Medicare.

Other Smart Money Points:

- 10:05 – Planning IRA Withdrawals.

- 11:20 – Roth Conversions.

- 15:36 – Deferring Social Security.

- 17:36 – Old Social Security Rules.

The Answer:

Do You Have A Smart Money Question?

Ask Matt your smart money question. Click here.

More From Matt:

The host: Matt Hausman – Contact – Resources – Call: 610-719-3003

Subscribe To The “Smart Money Questions” Podcast: